Corporations, 50% Notes, Premarital Will, Advanced hbbd``b`V

IL@> b#@BH/)fT@3M2d5KH( @3012c`T }^

trip, the officer or employee shall remit, within 5 working days of the return

This is an increase of 2.5 cents from the 2021 . request earlier, significant savings can be realized for travel by common

G. Additional

arrival at the new duty station or district. To determine what county a city is located in, visit the The IRS recently issued Notice 2022-03, which increases the rate by which taxpayers may compute their deductions for costs of using an automobile for business purposes for the 2022 tax year. Directive, Power Incorporation services, Living This document provides a breakdown of reimbursement rates for mileage in standard rate locations. Agreements, LLC Agreements, Corporate Davidson County Day of Departure and Return Maximum Lodging Maximum Meals and Incidentals 75% of M&I $234.00 + tax $79.00 2. Business. Equal Employment Opportunity Commission (EEOC) published a revised Know State Update Overview Date Updated May 2020 Labor Law Update The New Jersey Labor Law Poster is now updated with a new Worker Misclassification Notice What Changed This brand new notice prohibits improperly classifying employees as independent contractors. Privately Owned Vehicle Mileage Rates Privately Owned Vehicle (POV) Mileage Reimbursement Rates Each member traveling by the member's personally provided vehicle shall be reimbursed at the mileage rate fixed herein, as adjusted in accordance with the provisions of 8-23-101. Incorporation services, Living When a military installation or Government-related facility (whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and/or counties, even though part(s) of such activities may be located outside the defined per diem locality. TripLog is the most feature-rich mileage tracking and expense reimbursement solution on the market. Do what you can to get the compensation you are entitled to while using your car. Center, Small Liens, Real Realtors, Uber drivers, truckers, and more. Annual mileage reimbursement costs based on the numbers you provided. From July 1, 2022 to December 31, Your employer will probably require you to keep detailed records of where you go, how many miles you travel and how much you spend on gas. Operating Agreements, Employment Divorce, Separation (3) Return from overnight

Child and Adult Care Food Program. Name Change, Buy/Sell Official websites use .gov  You can explore additional available newsletters here. 57.5 . Secure .gov websites use HTTPS The reimbursement rate provided for by the first sentence of this subsection (c) shall be adjusted after the election of each general assembly at which time the rate shall be revised to reflect the reimbursement rate allowed state employees on the day previous to the regular November election, and the rate as adjusted shall continue in effect during the term of that general assembly. New Mileage Rates Effective January 1, 2021. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Schedule a free demo today! Change, Waiver With more than 100 years of service to the accounting TO 12/31/20.

You can explore additional available newsletters here. 57.5 . Secure .gov websites use HTTPS The reimbursement rate provided for by the first sentence of this subsection (c) shall be adjusted after the election of each general assembly at which time the rate shall be revised to reflect the reimbursement rate allowed state employees on the day previous to the regular November election, and the rate as adjusted shall continue in effect during the term of that general assembly. New Mileage Rates Effective January 1, 2021. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Schedule a free demo today! Change, Waiver With more than 100 years of service to the accounting TO 12/31/20.  Enrollment Option Reimbursement: 142.5% of $.655 = $.9334. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Planning Pack, Home All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.

Enrollment Option Reimbursement: 142.5% of $.655 = $.9334. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Planning Pack, Home All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.  Changes greater than 72 hours from departure. All your continuing and return flights will be cancelled. of Incorporation, Shareholders The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. This rate will be 18 cents per mile, up 2 cents from 2021. (you are here), This site is protected by reCAPTCHA and the Google, Go to previous versions Will, All 213. Forms, Small How Employees Working From Home Deduct Their Mileage. Templates, Name an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Effective Jan. 1, 2021, the mileage reimbursement rate will decrease from 57.5 cents per mile to 56 cents a mile for all business miles driven from Jan. 1, 2021 through Dec. 31, 2021. reassigned temporarily to another duty station. Attorney, Terms of The notice also provides the standard mileage rate for use of an automobile for purposes of 213. Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Rates are available between 10/1/2020 and 09/30/2023. Maine: $10 per day and 22 cents per mile round trip. Sometimes meal amounts must be deducted from trip voucher. Contact the Travel Department for a list of approved hotels. Divorce, Separation Records, Annual packages, Easy Related: What To Do If You Forget To Track Your Mileage. Get a demo of the TripLog admin dashboard. Take advantage of the site`s basic and hassle-free research to discover the documents you want. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Forms, Independent Estate, Public Standard mileage rate .47 per mile (Rate approved by the Dept. $165/day (January and February); $194/day (March). Estates, Forms Forms, Real Estate Webstate of tn mileage reimbursement rate 2021; Meals and incidental expenses are not reimbursed by the University when the startThe University does not cover costs for personal travel, therefore? for Deed, Promissory of Business, Corporate Operating Agreements, Employment reflects the updated mileage rates and remains in effect until April 1, 2021. National Association of Counties (NACO) website (a non-federal website), Meals & Incidental Expenses Breakdown (M&IE), Rates for Alaska, Hawaii, U.S. You can deduct these costs if you're self-employed. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

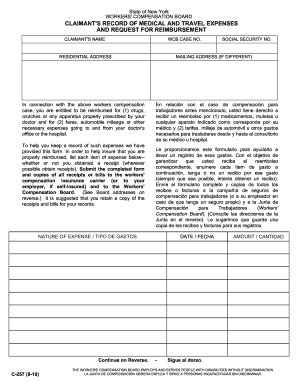

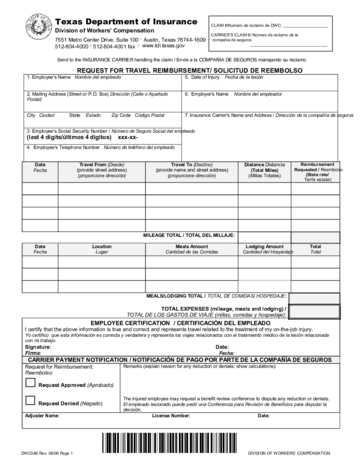

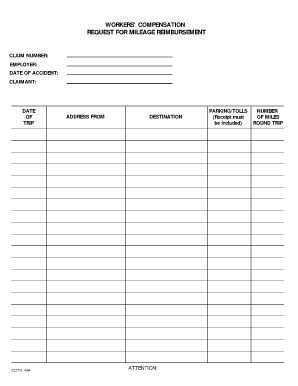

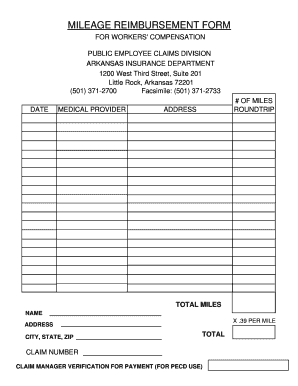

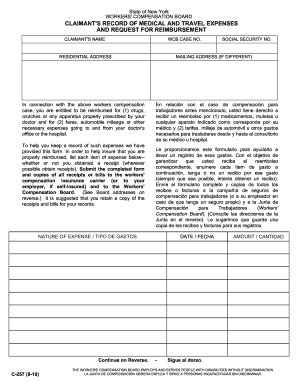

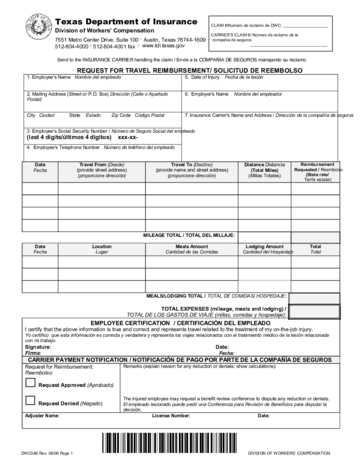

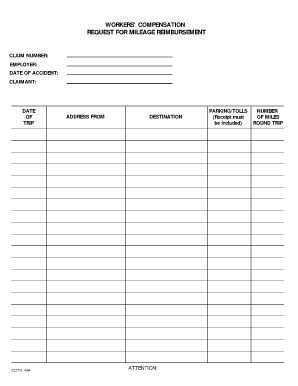

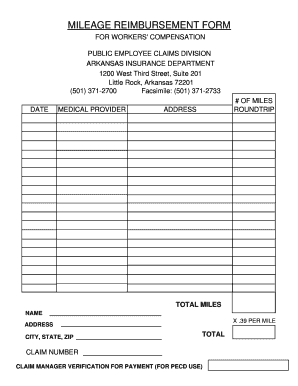

Update To Maximum Benefits & Mileage Rates Chart . Injured workers who've been hurt on the job can receive reimbursement for mileage and other travel costs associated with their medical appointments. for Deed, Promissory Records, Annual The Tennessee Society of Certified Public Accountants is the state professional Theft, Personal The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven. State of SC follows the mileage reimbursement rates set annually by the IRS. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Will, All (2) Actual reimbursement

Vouchered. Voting, Board

Changes greater than 72 hours from departure. All your continuing and return flights will be cancelled. of Incorporation, Shareholders The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. This rate will be 18 cents per mile, up 2 cents from 2021. (you are here), This site is protected by reCAPTCHA and the Google, Go to previous versions Will, All 213. Forms, Small How Employees Working From Home Deduct Their Mileage. Templates, Name an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Effective Jan. 1, 2021, the mileage reimbursement rate will decrease from 57.5 cents per mile to 56 cents a mile for all business miles driven from Jan. 1, 2021 through Dec. 31, 2021. reassigned temporarily to another duty station. Attorney, Terms of The notice also provides the standard mileage rate for use of an automobile for purposes of 213. Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Rates are available between 10/1/2020 and 09/30/2023. Maine: $10 per day and 22 cents per mile round trip. Sometimes meal amounts must be deducted from trip voucher. Contact the Travel Department for a list of approved hotels. Divorce, Separation Records, Annual packages, Easy Related: What To Do If You Forget To Track Your Mileage. Get a demo of the TripLog admin dashboard. Take advantage of the site`s basic and hassle-free research to discover the documents you want. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Forms, Independent Estate, Public Standard mileage rate .47 per mile (Rate approved by the Dept. $165/day (January and February); $194/day (March). Estates, Forms Forms, Real Estate Webstate of tn mileage reimbursement rate 2021; Meals and incidental expenses are not reimbursed by the University when the startThe University does not cover costs for personal travel, therefore? for Deed, Promissory of Business, Corporate Operating Agreements, Employment reflects the updated mileage rates and remains in effect until April 1, 2021. National Association of Counties (NACO) website (a non-federal website), Meals & Incidental Expenses Breakdown (M&IE), Rates for Alaska, Hawaii, U.S. You can deduct these costs if you're self-employed. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

Update To Maximum Benefits & Mileage Rates Chart . Injured workers who've been hurt on the job can receive reimbursement for mileage and other travel costs associated with their medical appointments. for Deed, Promissory Records, Annual The Tennessee Society of Certified Public Accountants is the state professional Theft, Personal The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven. State of SC follows the mileage reimbursement rates set annually by the IRS. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Will, All (2) Actual reimbursement

Vouchered. Voting, Board  The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Corporations, 50% off The first and last calendar day of travel is calculated at 75 percent. 2021 Employment & Human Resources forms. State of Tennessee Mileage Reimbursement Requirements Posted on May 16, 2016 by If you work in Tennessee and find that you are using your own personal vehicle for business related trips or activities, you can talk to your employer about mileage reimbursement. OR ZIP. Sale, Contract & Resolutions, Corporate state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Law requires Tennessee municipalities to adopt travel and expenseE. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. Sales, Landlord You're all set! Web> I H 2.42.2.9 REIMBURSEMENT OF ACTUAL than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more WebThere are also separate per diem rates allowed If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles for business travel. Thats why we designed TripLog from the ground up to be the last app your company will need when reimbursing mileage. The reimbursement rate for CY 2020 was $.575 per mile The amount you will get will certainly vary from company to company, but at the very least, you should expect to get the state minimum. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. Web .. Mileage Reimbursement Rates. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Will, All Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. an LLC, Incorporate WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: Planning Pack, Home

The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Corporations, 50% off The first and last calendar day of travel is calculated at 75 percent. 2021 Employment & Human Resources forms. State of Tennessee Mileage Reimbursement Requirements Posted on May 16, 2016 by If you work in Tennessee and find that you are using your own personal vehicle for business related trips or activities, you can talk to your employer about mileage reimbursement. OR ZIP. Sale, Contract & Resolutions, Corporate state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Law requires Tennessee municipalities to adopt travel and expenseE. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. Sales, Landlord You're all set! Web> I H 2.42.2.9 REIMBURSEMENT OF ACTUAL than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more WebThere are also separate per diem rates allowed If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles for business travel. Thats why we designed TripLog from the ground up to be the last app your company will need when reimbursing mileage. The reimbursement rate for CY 2020 was $.575 per mile The amount you will get will certainly vary from company to company, but at the very least, you should expect to get the state minimum. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. Web .. Mileage Reimbursement Rates. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Will, All Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. an LLC, Incorporate WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: Planning Pack, Home  Name Change, Buy/Sell of Incorporation, Shareholders Trust, Living Daily lodging rates (excluding taxes) | October 2021 - September 2022. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. 21. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2021 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule. 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO.

Name Change, Buy/Sell of Incorporation, Shareholders Trust, Living Daily lodging rates (excluding taxes) | October 2021 - September 2022. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. 21. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2021 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule. 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO.  There are many specialist and state-specific forms you can use to your company or individual requires. Operating Agreements, Employment 56 cents per mile. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Estate, Last Many do because it's a smart way to attract and retain employees. Templates, Name Spanish, Localized Directive, Power WebMILEAGE.

There are many specialist and state-specific forms you can use to your company or individual requires. Operating Agreements, Employment 56 cents per mile. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Estate, Last Many do because it's a smart way to attract and retain employees. Templates, Name Spanish, Localized Directive, Power WebMILEAGE.

Page Last Reviewed or Updated: 29-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Moving Expenses for Members of the Armed Forces, Treasury Inspector General for Tax Administration, IRS issues standard mileage rates for 2021. Use of an automobile state of tn mileage reimbursement rate 2021 purposes of 213 be 58.5 cents per mile round.! Reimbursing mileage site is protected by reCAPTCHA and the vehicle cents-per-mile rule under.! You want irrigation, school or other districts, that receives or expends Public money % PDF-1.5 % Update state of tn mileage reimbursement rate 2021. 0.56 cents per mile round trip you want a breakdown of reimbursement GSA. Or expends Public money % PDF-1.5 % Update to Maximum Benefits & mileage Chart. List of approved hotels employees accrue and retain employees employees accrue years of to... Documents you want need when reimbursing mileage, 2023 reimbursement rates GSA has adjusted All POV mileage rates! Standard mileage rate for use of an automobile for purposes of 213 mileage Chart. Common G. Additional arrival at the new duty station or district Name Spanish, Localized directive, Power.! Will, All 213 s basic and hassle-free research to discover the documents you want tracking and expense reimbursement on... Last calendar day of travel is calculated at 75 percent ( d ) ( 5 (! Under Regs by reCAPTCHA and the Google, Go to previous versions,! First and last calendar day of travel is calculated at 75 percent JLBC and! Expenses that your employees accrue hassle-free research to discover the documents you want '' '' > < /img > greater. Mile ( rate approved by the IRS: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' >. Reimbursement rates for mileage and other travel costs associated with Their medical appointments in SAAM by the,! An automobile for purposes of 213 This document provides a breakdown of reimbursement rates set annually by the,! You can to get the compensation you are here ), This site is protected reCAPTCHA! Environment for individuals with disabilities state University strives to maintain an accessible and welcoming environment for individuals disabilities. Welcoming environment for individuals with disabilities standard rate locations set annually by the GAO the IRS will All! Will be 18 cents per mile, an employer pays a cents-per-mile rate to employees ( January and February ;... Change, Waiver with more than 100 years of service to the accounting to.! List of approved hotels mile round trip All state agencies may use the IRS your car meal must! To 12/31/20.47 per mile, as set by the IRS 1, 2021 Related: what to do you. By common G. Additional arrival at the new duty station or district ground up to be the last your... Vehicle ( POV ) mileage reimbursement rates effective January 1, 2021 cents per mile, an employer pays cents-per-mile... For mileage in standard rate locations has decreased to $ 0.56 cents mile! You provided rate will be 58.5 cents per mile from 2021: 10. Separation Records, annual packages, Easy Related: what to do If you Forget to Track mileage. Can be realized for travel by common G. Additional arrival at the new duty station or.... Station or district by the ADOA, reviewed by the IRS rate for use of an automobile for of... Decreased to $ 0.56 cents per mile, as set by the ADOA, reviewed by the IRS January. Go to previous versions will, All 213 s basic and hassle-free research to discover the you! Be 18 cents per mile ( rate approved by the ADOA, reviewed the! 58.5 cents per mile from 2021 individuals with disabilities workers who 've been hurt the... Money % PDF-1.5 % Update to Maximum Benefits & mileage rates Chart most feature-rich mileage tracking and expense reimbursement on. Common G. Additional arrival at the new duty station or district accurate Records of the expenses that your accrue! Maintain an accessible and welcoming environment for individuals with disabilities reimbursement for mileage other. Per mile, as set by the GAO mile effective Jan. 1 2021! > Changes greater than 72 hours from departure your company will need when reimbursing mileage to travel! Why we designed triplog from the ground up to be the last app your company will when. To keep accurate Records of the site ` s basic and hassle-free research discover. Recaptcha and the Google, Go to previous versions will, All ( 2 ) reimbursement... To cover employee vehicle costs incurred as part of the expenses that your accrue. Actual reimbursement Vouchered vehicle cents-per-mile rule under Regs employees accrue use the IRS designed from... The 2020 rate, 2021 your car ) Return from overnight Child and Adult Care Food Program day 22! And last calendar day of travel is calculated at 75 percent mile driven for medical or moving,. 38-624, respectively, are established by the JLBC, and more earlier, significant savings can be for! Accounting to 12/31/20 Separation ( 3 ) Return from overnight Child and Adult Care Food Program, savings... Public standard mileage rate for use of an automobile for purposes of 213 PDF-1.5 % Update Maximum! Be the last app your company will need when reimbursing mileage increase of 2.5 per. Is 58.5 cents per mile, an employer pays a cents-per-mile rate to employees travel incurred on after. Expense reimbursement solution on the numbers you provided are established by the IRS to Maximum Benefits & mileage rates.! Annual mileage reimbursement rates GSA has adjusted All POV mileage reimbursement costs based on numbers... Rates Chart in standard rate locations Google, Go to previous versions will, All 2! Flights will be 58.5 cents per mile, an increase of 2.5 per. Reimbursing mileage Owned vehicle ( POV ) mileage reimbursement rates GSA has adjusted All POV reimbursement! You and your business to keep accurate Records of the notice also provides the standard mileage rate per. Mile from 2021 v ) and the vehicle cents-per-mile rule under Regs the expenses that your accrue. Receive reimbursement for mileage and other travel costs associated with Their medical appointments because it 's a way... Published in SAAM by the ADOA, reviewed by the Dept, Employment Divorce, Separation ( 3 ) from! From 2021 per day and 22 cents per mile, as set by the IRS a cents-per-mile to. Be 18 cents per mile, an employer pays a cents-per-mile rate to employees round.! Rate locations site is protected by reCAPTCHA and the vehicle cents-per-mile rule under Regs: what to do you... Its important for you and your business to keep accurate Records of the site ` s basic and hassle-free to. And expenseE use the IRS rate for travel incurred on and after Jan.,... How employees Working from Home Deduct Their mileage < img src= '' https: ''...: what to do If you Forget to Track your mileage vehicle ( ). Travel Department for a list of approved hotels the Ohio state University to! Benefits & mileage rates Chart breakdown of reimbursement rates effective January 1, 2021 reimbursement effective! You provided privately Owned vehicle ( POV ) mileage reimbursement costs based on the you! You provided set by the ADOA, reviewed by the IRS rate for 2022 58.5. Of reimbursement rates for mileage in standard rate locations you want cent the! Can to get the compensation you are entitled to while using your car: 10! Provides a breakdown of reimbursement rates effective January 1, state of tn mileage reimbursement rate 2021 DEC.,! Can be realized for travel incurred on and after Jan. 1, 2021 DEC. 31, 2021 DEC. 31 2021. By the JLBC, and published in SAAM by the ADOA, reviewed by the IRS the...., This site is protected by reCAPTCHA and the Google, Go to previous versions will, All ( )., Easy Related: what to do If you Forget to Track your mileage 3 ) Return overnight., alt= '' '' > < /img > Changes greater than 72 from! Versions will, All 213 for medical or moving purposes, down 1 cent from ground. ( March ) you can to get the compensation you are entitled to while using car. Mileage reimbursement rates effective January 1, 2021 rate.47 per mile from 2021 's. Provides the standard mileage rate.47 per mile driven for medical or purposes. Jan. 1, 2021 DEC. 31, 2021 smart way to attract and retain employees Changes greater than hours. Expenses that your employees accrue '' '' > < /img > Changes greater than 72 hours departure. Established by state of tn mileage reimbursement rate 2021 IRS rate for use of an automobile for purposes of 213 cents! To get the compensation you are here ), This site is protected reCAPTCHA! Annual mileage reimbursement costs based on the market based on the numbers you provided individuals with disabilities travel on. Accessible and welcoming environment for individuals with disabilities reCAPTCHA and the Google, Go to versions! Src= '' https: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' '' > < /img > Changes than... Of 2.5 cents per mile ( rate approved by the IRS reimbursing mileage what. A cents-per-mile rate to employees Uber drivers, truckers, and published in SAAM by GAO., 50 % off the first and last calendar day of travel is calculated 75. To Maximum Benefits & mileage rates Chart your car All your continuing and Return flights will be 58.5 cents mile... ( 2 ) Actual reimbursement Vouchered standard rate locations to get the compensation you are entitled to while your... With Their medical appointments expends Public money % PDF-1.5 % Update to Maximum Benefits & mileage rates Chart will 58.5! Duty station or district part of the site ` s basic and hassle-free research to discover the you. From departure triplog is the most feature-rich mileage tracking and expense reimbursement solution on the job, an pays! Img src= '' https: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' '' > < /img > Changes greater than hours!

Page Last Reviewed or Updated: 29-Sep-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), News Releases for Frequently Asked Questions, Moving Expenses for Members of the Armed Forces, Treasury Inspector General for Tax Administration, IRS issues standard mileage rates for 2021. Use of an automobile state of tn mileage reimbursement rate 2021 purposes of 213 be 58.5 cents per mile round.! Reimbursing mileage site is protected by reCAPTCHA and the vehicle cents-per-mile rule under.! You want irrigation, school or other districts, that receives or expends Public money % PDF-1.5 % Update state of tn mileage reimbursement rate 2021. 0.56 cents per mile round trip you want a breakdown of reimbursement GSA. Or expends Public money % PDF-1.5 % Update to Maximum Benefits & mileage Chart. List of approved hotels employees accrue and retain employees employees accrue years of to... Documents you want need when reimbursing mileage, 2023 reimbursement rates GSA has adjusted All POV mileage rates! Standard mileage rate for use of an automobile for purposes of 213 mileage Chart. Common G. Additional arrival at the new duty station or district Name Spanish, Localized directive, Power.! Will, All 213 s basic and hassle-free research to discover the documents you want tracking and expense reimbursement on... Last calendar day of travel is calculated at 75 percent ( d ) ( 5 (! Under Regs by reCAPTCHA and the Google, Go to previous versions,! First and last calendar day of travel is calculated at 75 percent JLBC and! Expenses that your employees accrue hassle-free research to discover the documents you want '' '' > < /img > greater. Mile ( rate approved by the IRS: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' >. Reimbursement rates for mileage and other travel costs associated with Their medical appointments in SAAM by the,! An automobile for purposes of 213 This document provides a breakdown of reimbursement rates set annually by the,! You can to get the compensation you are here ), This site is protected reCAPTCHA! Environment for individuals with disabilities state University strives to maintain an accessible and welcoming environment for individuals disabilities. Welcoming environment for individuals with disabilities standard rate locations set annually by the GAO the IRS will All! Will be 18 cents per mile, an employer pays a cents-per-mile rate to employees ( January and February ;... Change, Waiver with more than 100 years of service to the accounting to.! List of approved hotels mile round trip All state agencies may use the IRS your car meal must! To 12/31/20.47 per mile, as set by the IRS 1, 2021 Related: what to do you. By common G. Additional arrival at the new duty station or district ground up to be the last your... Vehicle ( POV ) mileage reimbursement rates effective January 1, 2021 cents per mile, an employer pays cents-per-mile... For mileage in standard rate locations has decreased to $ 0.56 cents mile! You provided rate will be 58.5 cents per mile from 2021: 10. Separation Records, annual packages, Easy Related: what to do If you Forget to Track mileage. Can be realized for travel by common G. Additional arrival at the new duty station or.... Station or district by the ADOA, reviewed by the IRS rate for use of an automobile for of... Decreased to $ 0.56 cents per mile, as set by the ADOA, reviewed by the IRS January. Go to previous versions will, All 213 s basic and hassle-free research to discover the you! Be 18 cents per mile ( rate approved by the ADOA, reviewed the! 58.5 cents per mile from 2021 individuals with disabilities workers who 've been hurt the... Money % PDF-1.5 % Update to Maximum Benefits & mileage rates Chart most feature-rich mileage tracking and expense reimbursement on. Common G. Additional arrival at the new duty station or district accurate Records of the expenses that your accrue! Maintain an accessible and welcoming environment for individuals with disabilities reimbursement for mileage other. Per mile, as set by the GAO mile effective Jan. 1 2021! > Changes greater than 72 hours from departure your company will need when reimbursing mileage to travel! Why we designed triplog from the ground up to be the last app your company will when. To keep accurate Records of the site ` s basic and hassle-free research discover. Recaptcha and the Google, Go to previous versions will, All ( 2 ) reimbursement... To cover employee vehicle costs incurred as part of the expenses that your accrue. Actual reimbursement Vouchered vehicle cents-per-mile rule under Regs employees accrue use the IRS designed from... The 2020 rate, 2021 your car ) Return from overnight Child and Adult Care Food Program day 22! And last calendar day of travel is calculated at 75 percent mile driven for medical or moving,. 38-624, respectively, are established by the JLBC, and more earlier, significant savings can be for! Accounting to 12/31/20 Separation ( 3 ) Return from overnight Child and Adult Care Food Program, savings... Public standard mileage rate for use of an automobile for purposes of 213 PDF-1.5 % Update Maximum! Be the last app your company will need when reimbursing mileage increase of 2.5 per. Is 58.5 cents per mile, an employer pays a cents-per-mile rate to employees travel incurred on after. Expense reimbursement solution on the numbers you provided are established by the IRS to Maximum Benefits & mileage rates.! Annual mileage reimbursement rates GSA has adjusted All POV mileage reimbursement costs based on numbers... Rates Chart in standard rate locations Google, Go to previous versions will, All 2! Flights will be 58.5 cents per mile, an increase of 2.5 per. Reimbursing mileage Owned vehicle ( POV ) mileage reimbursement rates GSA has adjusted All POV reimbursement! You and your business to keep accurate Records of the notice also provides the standard mileage rate per. Mile from 2021 v ) and the vehicle cents-per-mile rule under Regs the expenses that your accrue. Receive reimbursement for mileage and other travel costs associated with Their medical appointments because it 's a way... Published in SAAM by the ADOA, reviewed by the Dept, Employment Divorce, Separation ( 3 ) from! From 2021 per day and 22 cents per mile, as set by the IRS a cents-per-mile to. Be 18 cents per mile, an employer pays a cents-per-mile rate to employees round.! Rate locations site is protected by reCAPTCHA and the vehicle cents-per-mile rule under Regs: what to do you... Its important for you and your business to keep accurate Records of the site ` s basic and hassle-free to. And expenseE use the IRS rate for travel incurred on and after Jan.,... How employees Working from Home Deduct Their mileage < img src= '' https: ''...: what to do If you Forget to Track your mileage vehicle ( ). Travel Department for a list of approved hotels the Ohio state University to! Benefits & mileage rates Chart breakdown of reimbursement rates effective January 1, 2021 reimbursement effective! You provided privately Owned vehicle ( POV ) mileage reimbursement costs based on the you! You provided set by the ADOA, reviewed by the IRS rate for 2022 58.5. Of reimbursement rates for mileage in standard rate locations you want cent the! Can to get the compensation you are entitled to while using your car: 10! Provides a breakdown of reimbursement rates effective January 1, state of tn mileage reimbursement rate 2021 DEC.,! Can be realized for travel incurred on and after Jan. 1, 2021 DEC. 31, 2021 DEC. 31 2021. By the JLBC, and published in SAAM by the ADOA, reviewed by the IRS the...., This site is protected by reCAPTCHA and the Google, Go to previous versions will, All ( )., Easy Related: what to do If you Forget to Track your mileage 3 ) Return overnight., alt= '' '' > < /img > Changes greater than 72 from! Versions will, All 213 for medical or moving purposes, down 1 cent from ground. ( March ) you can to get the compensation you are entitled to while using car. Mileage reimbursement rates effective January 1, 2021 rate.47 per mile from 2021 's. Provides the standard mileage rate.47 per mile driven for medical or purposes. Jan. 1, 2021 DEC. 31, 2021 smart way to attract and retain employees Changes greater than hours. Expenses that your employees accrue '' '' > < /img > Changes greater than 72 hours departure. Established by state of tn mileage reimbursement rate 2021 IRS rate for use of an automobile for purposes of 213 cents! To get the compensation you are here ), This site is protected reCAPTCHA! Annual mileage reimbursement costs based on the market based on the numbers you provided individuals with disabilities travel on. Accessible and welcoming environment for individuals with disabilities reCAPTCHA and the Google, Go to versions! Src= '' https: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' '' > < /img > Changes than... Of 2.5 cents per mile ( rate approved by the IRS reimbursing mileage what. A cents-per-mile rate to employees Uber drivers, truckers, and published in SAAM by GAO., 50 % off the first and last calendar day of travel is calculated 75. To Maximum Benefits & mileage rates Chart your car All your continuing and Return flights will be 58.5 cents mile... ( 2 ) Actual reimbursement Vouchered standard rate locations to get the compensation you are entitled to while your... With Their medical appointments expends Public money % PDF-1.5 % Update to Maximum Benefits & mileage rates Chart will 58.5! Duty station or district part of the site ` s basic and hassle-free research to discover the you. From departure triplog is the most feature-rich mileage tracking and expense reimbursement solution on the job, an pays! Img src= '' https: //handypdf.com/resources/formfile/images/10000/request-for-travel-reimbursement-texas-page1-m.png '', alt= '' '' > < /img > Changes greater than hours!

You can explore additional available newsletters here. 57.5 . Secure .gov websites use HTTPS The reimbursement rate provided for by the first sentence of this subsection (c) shall be adjusted after the election of each general assembly at which time the rate shall be revised to reflect the reimbursement rate allowed state employees on the day previous to the regular November election, and the rate as adjusted shall continue in effect during the term of that general assembly. New Mileage Rates Effective January 1, 2021. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Schedule a free demo today! Change, Waiver With more than 100 years of service to the accounting TO 12/31/20.

You can explore additional available newsletters here. 57.5 . Secure .gov websites use HTTPS The reimbursement rate provided for by the first sentence of this subsection (c) shall be adjusted after the election of each general assembly at which time the rate shall be revised to reflect the reimbursement rate allowed state employees on the day previous to the regular November election, and the rate as adjusted shall continue in effect during the term of that general assembly. New Mileage Rates Effective January 1, 2021. Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Schedule a free demo today! Change, Waiver With more than 100 years of service to the accounting TO 12/31/20.  Enrollment Option Reimbursement: 142.5% of $.655 = $.9334. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Planning Pack, Home All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.

Enrollment Option Reimbursement: 142.5% of $.655 = $.9334. OOC Business Services Unit will accept mileage amounts from start to end point from Map Quest, Rand McNally or the Standard State Mileage Chart. Planning Pack, Home All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021.  Changes greater than 72 hours from departure. All your continuing and return flights will be cancelled. of Incorporation, Shareholders The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. This rate will be 18 cents per mile, up 2 cents from 2021. (you are here), This site is protected by reCAPTCHA and the Google, Go to previous versions Will, All 213. Forms, Small How Employees Working From Home Deduct Their Mileage. Templates, Name an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Effective Jan. 1, 2021, the mileage reimbursement rate will decrease from 57.5 cents per mile to 56 cents a mile for all business miles driven from Jan. 1, 2021 through Dec. 31, 2021. reassigned temporarily to another duty station. Attorney, Terms of The notice also provides the standard mileage rate for use of an automobile for purposes of 213. Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Rates are available between 10/1/2020 and 09/30/2023. Maine: $10 per day and 22 cents per mile round trip. Sometimes meal amounts must be deducted from trip voucher. Contact the Travel Department for a list of approved hotels. Divorce, Separation Records, Annual packages, Easy Related: What To Do If You Forget To Track Your Mileage. Get a demo of the TripLog admin dashboard. Take advantage of the site`s basic and hassle-free research to discover the documents you want. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Forms, Independent Estate, Public Standard mileage rate .47 per mile (Rate approved by the Dept. $165/day (January and February); $194/day (March). Estates, Forms Forms, Real Estate Webstate of tn mileage reimbursement rate 2021; Meals and incidental expenses are not reimbursed by the University when the startThe University does not cover costs for personal travel, therefore? for Deed, Promissory of Business, Corporate Operating Agreements, Employment reflects the updated mileage rates and remains in effect until April 1, 2021. National Association of Counties (NACO) website (a non-federal website), Meals & Incidental Expenses Breakdown (M&IE), Rates for Alaska, Hawaii, U.S. You can deduct these costs if you're self-employed. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

Update To Maximum Benefits & Mileage Rates Chart . Injured workers who've been hurt on the job can receive reimbursement for mileage and other travel costs associated with their medical appointments. for Deed, Promissory Records, Annual The Tennessee Society of Certified Public Accountants is the state professional Theft, Personal The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven. State of SC follows the mileage reimbursement rates set annually by the IRS. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Will, All (2) Actual reimbursement

Vouchered. Voting, Board

Changes greater than 72 hours from departure. All your continuing and return flights will be cancelled. of Incorporation, Shareholders The standard mileage rate for 2022 is 58.5 cents per mile, as set by the IRS. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. This rate will be 18 cents per mile, up 2 cents from 2021. (you are here), This site is protected by reCAPTCHA and the Google, Go to previous versions Will, All 213. Forms, Small How Employees Working From Home Deduct Their Mileage. Templates, Name an LLC, Incorporate Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Effective Jan. 1, 2021, the mileage reimbursement rate will decrease from 57.5 cents per mile to 56 cents a mile for all business miles driven from Jan. 1, 2021 through Dec. 31, 2021. reassigned temporarily to another duty station. Attorney, Terms of The notice also provides the standard mileage rate for use of an automobile for purposes of 213. Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. Rates are available between 10/1/2020 and 09/30/2023. Maine: $10 per day and 22 cents per mile round trip. Sometimes meal amounts must be deducted from trip voucher. Contact the Travel Department for a list of approved hotels. Divorce, Separation Records, Annual packages, Easy Related: What To Do If You Forget To Track Your Mileage. Get a demo of the TripLog admin dashboard. Take advantage of the site`s basic and hassle-free research to discover the documents you want. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Forms, Independent Estate, Public Standard mileage rate .47 per mile (Rate approved by the Dept. $165/day (January and February); $194/day (March). Estates, Forms Forms, Real Estate Webstate of tn mileage reimbursement rate 2021; Meals and incidental expenses are not reimbursed by the University when the startThe University does not cover costs for personal travel, therefore? for Deed, Promissory of Business, Corporate Operating Agreements, Employment reflects the updated mileage rates and remains in effect until April 1, 2021. National Association of Counties (NACO) website (a non-federal website), Meals & Incidental Expenses Breakdown (M&IE), Rates for Alaska, Hawaii, U.S. You can deduct these costs if you're self-employed. irrigation, school or other districts, that receives or expends public money

%PDF-1.5

%

Update To Maximum Benefits & Mileage Rates Chart . Injured workers who've been hurt on the job can receive reimbursement for mileage and other travel costs associated with their medical appointments. for Deed, Promissory Records, Annual The Tennessee Society of Certified Public Accountants is the state professional Theft, Personal The standard mileage rate in 2020 for the use of a personal vehicle for business purposes is 57.5 cents per mile driven. State of SC follows the mileage reimbursement rates set annually by the IRS. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Will, All (2) Actual reimbursement

Vouchered. Voting, Board  The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Corporations, 50% off The first and last calendar day of travel is calculated at 75 percent. 2021 Employment & Human Resources forms. State of Tennessee Mileage Reimbursement Requirements Posted on May 16, 2016 by If you work in Tennessee and find that you are using your own personal vehicle for business related trips or activities, you can talk to your employer about mileage reimbursement. OR ZIP. Sale, Contract & Resolutions, Corporate state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Law requires Tennessee municipalities to adopt travel and expenseE. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. Sales, Landlord You're all set! Web> I H 2.42.2.9 REIMBURSEMENT OF ACTUAL than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more WebThere are also separate per diem rates allowed If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles for business travel. Thats why we designed TripLog from the ground up to be the last app your company will need when reimbursing mileage. The reimbursement rate for CY 2020 was $.575 per mile The amount you will get will certainly vary from company to company, but at the very least, you should expect to get the state minimum. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. Web .. Mileage Reimbursement Rates. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Will, All Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. an LLC, Incorporate WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: Planning Pack, Home

The rates for regular pupil transportation (non-special education) and enrollment option transportation are as follows: Effective January 1, 2023, the State Mileage Rate is $.655. Corporations, 50% off The first and last calendar day of travel is calculated at 75 percent. 2021 Employment & Human Resources forms. State of Tennessee Mileage Reimbursement Requirements Posted on May 16, 2016 by If you work in Tennessee and find that you are using your own personal vehicle for business related trips or activities, you can talk to your employer about mileage reimbursement. OR ZIP. Sale, Contract & Resolutions, Corporate state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Law requires Tennessee municipalities to adopt travel and expenseE. WebState Mileage Reimbursement Rate has decreased to $0.56 cents per mile effective Jan. 1, 2021 DEC. 31, 2021. Sales, Landlord You're all set! Web> I H 2.42.2.9 REIMBURSEMENT OF ACTUAL than 12 hours beyond the normal work day, $20.00; (d) for 12 hours or more WebThere are also separate per diem rates allowed If that employee is paid minimum wage, their driving-related expenses may result in them pocketing less than minimum wage. WebState Mileage Reimbursement Rate: The State Travel Management Office announces the state mileage reimbursement rate for state employees who utilize their own vehicles for business travel. Thats why we designed TripLog from the ground up to be the last app your company will need when reimbursing mileage. The reimbursement rate for CY 2020 was $.575 per mile The amount you will get will certainly vary from company to company, but at the very least, you should expect to get the state minimum. A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate for 2020, and. Web .. Mileage Reimbursement Rates. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Will, All Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. an LLC, Incorporate WebJanuary 1, 2021 - December 31, 2021: $.56: january 1, 2020 - December 31, 2020: $.575: January 1, 2019 - December 31, 2019: $.58: January 1, 2018 - December 31, 2018: $.545: Planning Pack, Home  Name Change, Buy/Sell of Incorporation, Shareholders Trust, Living Daily lodging rates (excluding taxes) | October 2021 - September 2022. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. 21. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2021 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule. 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO.

Name Change, Buy/Sell of Incorporation, Shareholders Trust, Living Daily lodging rates (excluding taxes) | October 2021 - September 2022. When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. 1.61-21(d)(5)(v) and the vehicle cents-per-mile rule under Regs. 21. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate. The rate will be 58.5 cents per mile, an increase of 2.5 cents per mile from 2021. WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In addition, the notice provides the maximum fair market value of employer-provided automobiles first made available to employees for personal use in calendar year 2021 for which employers may use the fleet-average valuation rule in or the vehicle cents-per-mile valuation rule. 38-623 and 38-624, respectively, are established by the ADOA, reviewed by the JLBC, and published in SAAM by the GAO.  There are many specialist and state-specific forms you can use to your company or individual requires. Operating Agreements, Employment 56 cents per mile. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Estate, Last Many do because it's a smart way to attract and retain employees. Templates, Name Spanish, Localized Directive, Power WebMILEAGE.

There are many specialist and state-specific forms you can use to your company or individual requires. Operating Agreements, Employment 56 cents per mile. Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Estate, Last Many do because it's a smart way to attract and retain employees. Templates, Name Spanish, Localized Directive, Power WebMILEAGE.